Learn how

Sage 100 Accounts Receivable Maintenance with Sage 100 training classes

from Accounting Business Solutions by JCS!

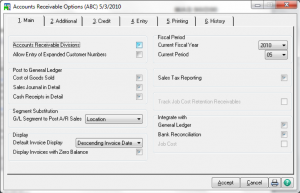

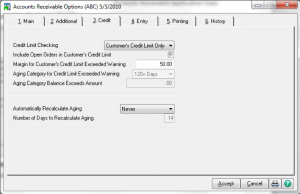

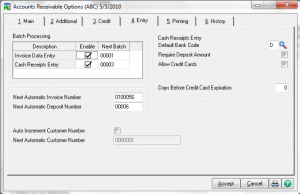

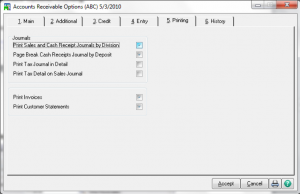

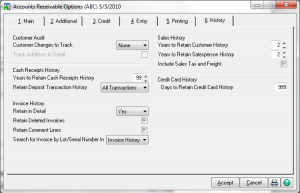

One of the most attractive features of Sage 100 is its flexibility, and the Sage 100 Accounts Receivable module is no exception. Sage 100 Accounts Receivable Maintenance contains a variety of options which can be customize to fit your particular needs.

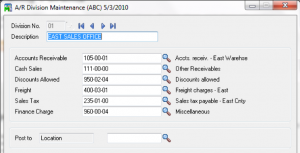

Division Maintenance

- GL Accounts are assigned by division

- All customers must be assigned to a division

- If divisions are created, they can be set to post to specified GL account segments

- Use 00 (default) if no divisions are to be tracked

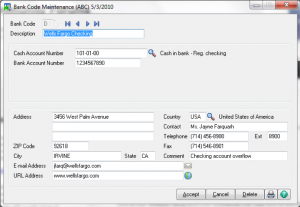

Bank Code Maintenance

- A is default bank code

- Bank Code Beginning Balances are entered through Bank Reconciliation

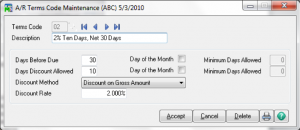

Terms Code Maintenance

- 00 is default terms code and cannot be deleted

- During invoice entry, discount amounts are calculated automatically and invoice and discount due dates display based on the assigned terms code.

- Although terms codes are assigned to customers in Customer Maintenance, you can change them in Invoice Data Entry.

- You can add new codes automatically using such tasks as Invoice Data Entry and Customer Maintenance.

- The Minimum Days Allowed field enables the proper calculation of the due date and discount date when the Day of the Month check box is selected.

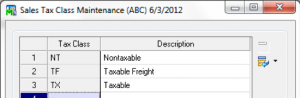

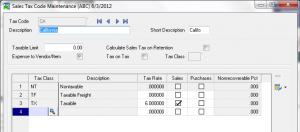

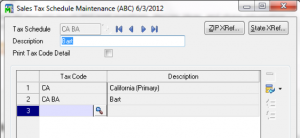

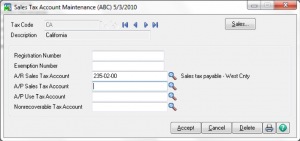

Sales Tax

- For calculation of sales tax in AR or SO

- Sales Tax Class Maintenance

- Sales Tax Code Maintenance

- Sales Tax Schedule Maintenance

Sales Tax Account Maintenance

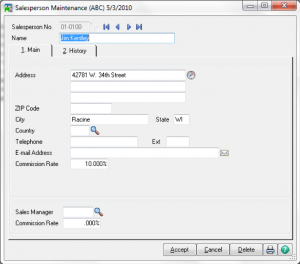

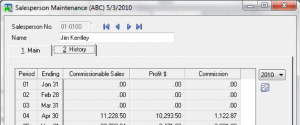

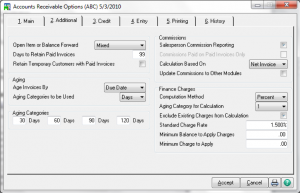

Sales Person Maintenance – Main

- Options for calculating and tracking commissions are entered in Accounts Receivable Options.

- A salesperson number and commission rate are assigned to each salesperson. The first two characters of the salesperson number indicate the division the salesperson is assigned.

- You can assign a default salesperson to each customer in Customer Maintenance; however, you can change the default salesperson when entering transactions in Invoice Data Entry.

- You can link salespersons to vendors, employees, or account numbers for commission tracking and payment if the Update Commissions to Other Modules check box is selected in Accounts Receivable Options.

– Click Link to establish these links.

Sales Person Maintenance – History

- Switch View

- Fix

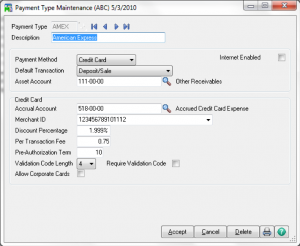

Payment Type Maintenance

- A default payment type of CHECK is created automatically and you cannot delete this payment type. CHECK is also assigned to new customers by default.

- The asset account number defined is debited when the payment posts in Sales Order.

- For Credit cards, the default transaction method selected determines how to handle the transfer of funds when recording credit card deposits and payments in Sales Order.

- The accrual account is used to post the estimated accrued expense associated with accepting a credit card for payment. This expense is accrued during the sales journal update process and posts to the account entered at the Accrual Account field.

- The merchant ID is your ID with the credit card company. This information does not display when receiving credit card deposits.

- The discount percentage rate, transaction fee, and authorization term are assigned by the merchant bank.

- Credit card expenses equal the discount percentage plus the per transaction fee.

- At the Validation Code Length field, enter the length of the validation code sent to the credit card server.

- Select the Allow Corporate Cards check box to accept corporate credit cards for the selected payment type.

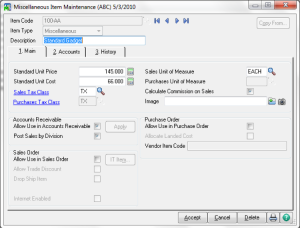

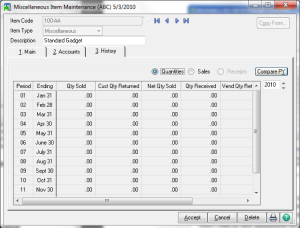

Miscellaneous Item Maintenance

Use Miscellaneous Item Maintenance on the Setup menu in Accounts Receivable or on the Common Information Main menu to identify and track miscellaneous products or services sold and purchased. This task is used primarily if Sales Order or Purchase Order and Inventory Management are not activated for the selected company.

Note: Items created through this task in Accounts Receivable are also available in Common Information and any other module containing the same task.

Miscellaneous Item Maintenance – Main

- During Invoice Data Entry, item codes are used to automatically display such information as the description, price, and cost for each item sold.

- The item code determines the posting to General Ledger for the sale of this item code when invoices are updated.

- The sales tax class selected determines if sales tax is calculated when the item is sold.

- For items or services sold in quantities, you can display a unit of measure on the customer’s invoice. The user is also prompted for a quantity in Invoice Data Entry.

- Select the Calculate Commission on Sales check box to calculate commission on this item code when entering transactions in Accounts Receivable.

- For both Miscellaneous and Charge Item Types, you can define a unit price and unit cost.

- You can define a sales, cost of goods sold, inventory, and purchases account on the Accounts tab for items assigned to the Miscellaneous item type.

- For the Charge item type, you cannot enter a unit of measure for item codes assigned to this type and you can only define a sales account and purchases account on the Accounts tab.

- Select Comment as the item type to enter a comment that you can add to an invoice. For example, you can enter a comment for warranty information or care instructions.

- Standard Codes M & C are available for one-time entries

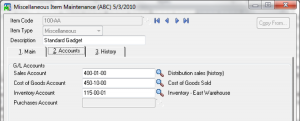

Miscellaneous Item Maintenance – Accounts

- The Cost of Goods Account and Inventory Account fields are only available if the Cost of Goods check box is selected in Accounts Receivable Options.

- If you selected to post sales by division, the appropriate subaccount segment value is replaced with the value defined for the division assigned to the customer in Division Maintenance.

Miscellaneous Item Maintenance – History

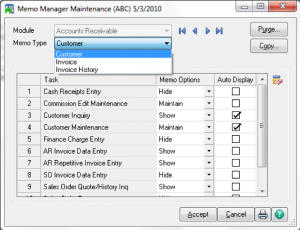

Memo Manager Maintenance

- Assign security roles to where memo’s can be created / viewed

Are you interested in learning how to maintain Sage 100 Accounts Receivable? Accounting Business Solutions by JCS offers Sage 100 training classes, including how to customize options in Accounts Receivable in Sage 100. Call us today at 800-475-1047 or email us at solutions@jcscomputer.com today to get started.