Sage 100 Credit Card Processing

What are the benefits of Sage 100 Credit Card Processing?

Sage 100cloud ERP credit card payment integration for Sage 100 ERP USA version – Request Pricing

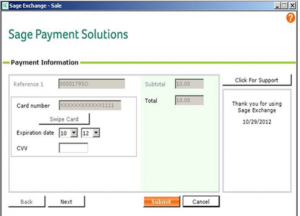

With Sage 100 payment processing there will be no more transposed credit card numbers or missed receipts in Accounts Receivable. Stay organized by working in a single solution to get your job done. Now you can email your invoices to customers and have them pay you immediately.

A complete Sage 100 payment processing solution easy to setup, easy to use. Sage 100 Payment Solutions gives Sage 100 (formerly Sage MAS 90 and Sage MAS 200) customers a fully integrated tool for processing customer payments. In customer cash receipts, in sales invoicing and via links in emails to customers. How easy is that current invoices, past due invoices in 1 simple step along with the confidence of secure credit purchase processing.

Sage 100 Paya Benefits

- Automatically connects to Merchant Accounts for credit card authorizations and settlements

- Accept Credit, debit, ACH, EFT, FSA, and recurring payments.

- PCI-compliant Sage 100 integration with EMV® Integration that is encrypted

- Flexible Pricing Options. Flat rate, interchange pass through, cost plus, and tiered.

- You may Qualify for a lower processing rate with Automatic Level 3 Data Enrichment

- Sage 100 Accounting additional benefits:

- Paya is the only Sage certified processor with native integration into Sage 100 Accounting.

- Accept Payments Anywhere. Over the phone or website with our integration to many leading e-commerce shopping carts and now from invoices emailed to clients.

- Recurring Credit Card Processing is Simplified

- Sage 100 merchant Payments automatically appear in the General Ledger, Cash Flow module and bank reconciliation modules. Accept payments on an invoice including partial or full payments.

It is simple the actual amount for each batch processed will be visible and cleared during the Sage 100 monthly bank reconciliation. The total fees for Paya merchant services with Sage 100 are deducted monthly and are easy to understand. Making this process so much easier to work with than ever before.

To start you’ll need a merchant account and then your customer credit card information will be help in a secure processing vault not on premise. This service for Sage 100 cloud can receive pre-authorizations on credit cards so you know the shipment will be paid for prior to fulfilling the shipment. Once you calculate the total of the order a deposit for the charge can be made immediately.

Once your merchant account is established it is easy to get started. In company maintenance you will need to activate the merchant services on the payment file tab.

Credit card processing inside Sage 100 can be included in these transaction types:

- Sales Order Processing – this is the transaction that is most commonly used for pre-authorization

- Sales Order Invoice Processing – partial, full and use with pre-authorized transactions

- Accounts Receivable Cash Receipts – for payments on accounts and previously posted invoices

- NEW Click2Pay Uses paperless office to provide a link via an email for customer to pay direct.

- Sage 100 Accounts Receivable Invoice Data Entry

Request Pricing

sage 100 payment processing, sage 100 credit card processing, sage 100 Merchant services, sage payment center, sage credit card processing, sage mobile payments