Learn about Receiving and Invoicing Purchase Orders in Sage 100 with Sage 100 training classes from Accounting Business Solutions by JCS!

Receiving and Invoicing Purchase Orders

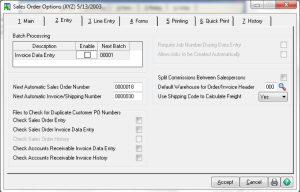

Batch Entry

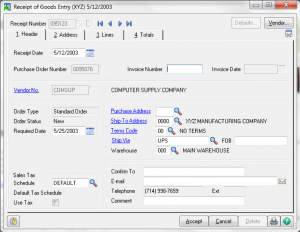

Receipt of Goods Entry – Header

- If an invoice is received with the goods, you can enter the invoice number.

- If the invoice is not processed with the goods, the purchases clearing account is credited and later debited when the invoice is processed.

- To enter an invoice after the receipt of goods, use Receipt of Invoice Entry.

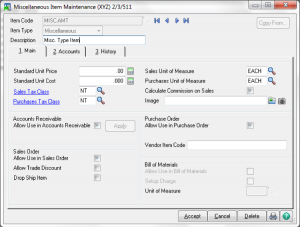

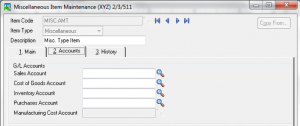

- There is no general ledger posting for miscellaneous items until the receipt of invoice posting.

- If the invoice is not received and processed with the goods, the order retains a Back Order status until the invoice is processed.

Receipt of Goods Entry – Address

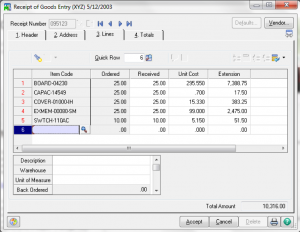

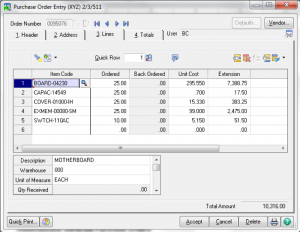

Receipt of Goods Entry – Lines

- When you first access the Lines tab, a dialog box will ask if you want to receive the order complete.

- You can access the Received and Back Order fields but not the Ordered field.

- When using landed costs, a Landed Cost check box displays for each line item.

- When receiving lot or serial number items, you must distribute the total quantity received to one or more lot/serial numbers.

- You must select a taxable tax class if sales tax is allocated to the cost of the item.

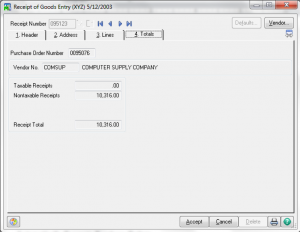

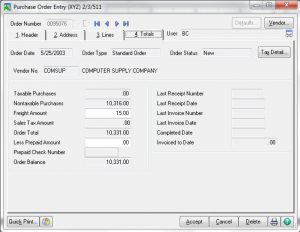

Receipt of Goods Entry – Total (no Invoice)

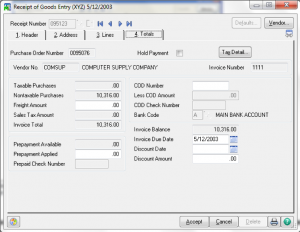

Receipt of Goods Entry – Total (with Invoice # entered)

- The Landed Cost button is only available if it has been allowed in options.

- Amounts to allocate are entered by type.

- Amounts will be only distributed to items with the Landed Cost box checked.

- Landed Cost can ONLY be entered on Receipt of Goods, NOT on Receipt of Invoice.

- Landed Cost can ONLY be entered at Receipt of Goods.

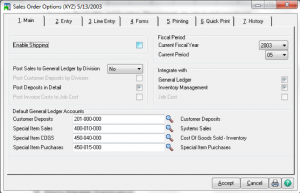

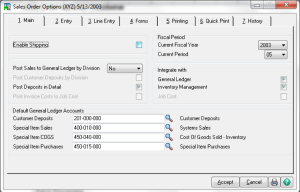

- Sales tax is calculated only if the Allow Tax and Freight Entry During Receipt/ Return of Goods Without an Invoice check box is selected in Purchase Order Options.

- Sales tax is calculated for the tax codes assigned to the tax schedule selected on the Header tab.

- Only the non-recoverable percentage defined for each tax class is allocated.

- Sales tax is calculated on freight only if freight is set up as taxable.

Recording Invoices separately from Receipt of Goods

Invoices may be recorded separately from the Receipt of Good. If this is done, both documents must be entered if you want to affect inventory counts. Receipt of Invoice does not affect Inventory quantities. The Receipt of Invoice window looks and works similarly to the Receipt of Goods window.

- You cannot receive goods in this task

- You do not need to receive the goods to enter a receipt of an invoice.

- If the invoice amount is different from the receipt of goods amount for an item, the difference posts to the purchase order variance adjustment account in Product Line Maintenance.

Adjusting Receipt / Invoice Variances

- You can review any variation between quantities received and invoiced or changes to sales tax when you print the Receipt/Invoice Variance Register and the variance amounts post or adjust in General Ledger.

- You can correct variation in unit cost using the Adjustment feature in Inventory Management Transaction Entry.

- When using the Average, LIFO/FIFO, or Lot/Serial valuation method, you must enter two adjustment lines, the first line entering a negative receipt and the second a positive quantity against the same cost tier, lot or serial# with the correct cost.

Printing and Updating

Are you interested in learning about Receiving and Invoicing Purchase Orders in Sage 100? Accounting Business Solutions by JCS offers Sage 100 training classes, including Purchase Clearing Reports in Sage 100. Call us today at 800-475-1047 or email us at solutions@jcscomputer.com today to get started.