Compare Accounting Software Systems

Compare Accounting Software Systems

Find Demo

Reach out Today! Give us a call

Get promotional pricing

send us an email!

Accounting Software Systems – every day, more and more small businesses come to us eager to learn how to manage their business information using the tools they already own. We are here to help and transfer as much knowledge about best practices for your success as we can. Sometimes the solution is a more robust platform to support your business operations, internal processes and growth demands. Often we help find an add-ons to solve for operational challenges.

Top 3 Benefits of leveraging the Right Software Solutions

- Identify issues before they become a crisis with advanced reporting.

- Elevate Business Performance with better Visibility

- Optimize team collaboration by gaining instant access to shared, real time data

On a daily basis we help small businesses balance quality and growth by leveraging the advanced features and using your accounting technology to the max. Discover how to go beyond just accounting and gain viability into your operations so you can get back to business and find new customers. More and more successful, thriving small businesses are reaping the benefits of using all the tools in their small business accounting software.

Don’t get left behind! Compare Best Accounting Software Systems

Accounting Business Solutions by JCS can help you compare the differences between the accounting software systems to determine if they are a fit for your business model. Discover QuickBooks, Sage 100 and Sage 50 the Top Ranked systems and learn how they are rated and why their advanced features matter to other small businesses. Find out which accounting software system is the best solution for your small business by reviewing each of them independently and asking questions to learn best practices for how they could be useful tools. Find promotional offers on Sage 100, Sage 50 and QuickBooks software.

See for yourself!

Learn More

Go beyond just accounting by attending a training class and learn how to drive your growth.

Take a closer look – Schedule an Accounting Software Systems Demo

Would you like to see an accounting software demo before you make the purchase?

An Accounting software system demo will let you see and feel how things will be better if you choose to purchase a new accounting software system. We can help you review based on your business model and our vertical market expertise. Accounting Software demos allow you to

- See the software in action

- Work around your schedule

- Ask Questions specific to your business and internal processes

- Focus on areas where you have the biggest challenges that need solutions

- Have as many demos as you need

- Talk to a real person who has real world experience

If you want to book an online accounting software demonstration it couldn’t be easier! Just pick a time and date that suits you, and we’ll send you details of the online session via email. Schedule your review accounting software solutions and discuss your business model give us a call.

Examine Sage 100 ERP Software – Free Deep Dive Demo

Have you outgrown your current accounting software? Do you need a more robust accounting software solution that provides end to end capabilities? Accounting Business Solutions can help you study the options to help you make an informed decision. Find Sage 100 Month End Close Checklist.

Sign up for a one-to-one demo. This personalized tour of Sage 100 Accounting Software can be customized to your business needs so you can see how Sage 100 can work for you. Sage 100 is a great fit for distribution and manufacturing that need to manage inventory information. The top 5 reasons to get a handle on your inventory:

- Reduce costs

- Manage Forecasting

- Close more sales

- Avoid Overstocking

- Get accurate counts of your inventory levels

What are the new features found in Sage 100?

Do you want to go paperless? Well now you can, create a repository of all your documents and organize them so you can find information faster.

- Automatic Update of Daily Transaction Register

A security event has been added to Role Maintenance that allows you to automatically update the Daily Transaction Register. For any series of journal and register updates that concludes with the Daily Transaction Register, you will not receive a prompt to print and update the register if the security event check box is selected for your role. The Daily Transaction Register will be printed and updated automatically.

- The security event has been added for the following modules:

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Bill of Materials

- Inventory Management

- Job Cost

- Purchase Order

- Sales Order

- Work Order

- Accounts Payable Expense Distribution table has been expanded

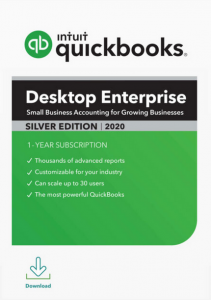

Discover QuickBooks Accounting Software System

Find our if QuickBooks Accounting Software is right for your business. Discover if upgrading from older versions of QuickBooks Accounting to QuickBooks Enterprise would help your business.

Sign up for a one-to-one demo. This personalized tour of Quick Books Accounting Software can be customized to your business needs so you can see how QuickBooks can work for you. QuickBooks is rated the number one Small Business Accounting Software for businesses today. JCS also provides QuickBooks Support and Training. Find your QuickBooks Month End Close Checklist.

What are the new features found in QuickBooks Enterprise?

- New the diamond package

- Landed Cost

- Alternate Vendor Center

- Express Pick Pack

- And More

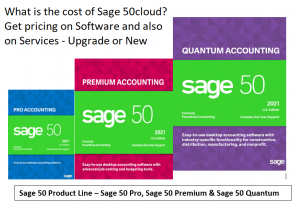

Review Sage 50 Accounting Software System

Do you need an accounting software system that is right for your business and easy to use?

Sign up for a one-to-one demo. This personalized tour of Sage 50 Accounting Software can be customized to your business needs so you can see how Sage 50 can work for you. Hands down Sage Software is the largest supplier of Small Business Accounting Software today. JCS also provides Sage 50 Support and Training. Find Sage 50 Month End Close Checklist.

What are the new features found in Sage 50 Cloud?

- Online and mobile invoicing and payment.

- Microsoft Office 365 integration.

- Automatic cloud backup using the Microsoft Office 365 integration.

- Read-only access to a Sage Drive company.

- Learn Morn schedule your free demo give us a call today 800-475-1047.

Do you need a more powerful manufacturing software solution?

Sign up for a one-to-one demo. This personalized tour of Sage 100 manufacturing for Sage 100 accounting software can be customized to your business needs so you can see how Sage 100 Manufacturing and Sage 100 can work for you. Sage 100 Production Manager a module for Sage 100 with seamless integration and is specifically designed for manufacturing companies and is customizable and scalable. Sage is the largest supplier of Small Business Accounting Software today. JCS also provides Sage 100 Manufacturing and Sage 100 Support and Training. Call today 800-475-1047.

What are the new features found in Sage 100 Manufacturing?

Sage 100 users will receive the new manufacturing capabilities via the same modernized platform as Sage 100. Capable of all the conveniences available in other modules including:

- Primary and secondary data entry grids.

- Resizable windows.

- Batch data entry.

- Right-click context menus.

- Grid export to Excel.

- Custom scripting.

- And more!

Integrated with QuickBooks and Sage 50 Software

Sign up for a one-to-one demo. This personalized tour of MISys Software for QuickBooks or Sage 50 can be customized to your business needs so you can see how MISys can work for you. MISys and QuickBooks or Sage 50 are specifically designed for manufacturing companies. If you need Small Business Manufacturing Software this combination would fit your business. JCS also provides MISYS and QuickBooks and Sage 50 Support and Training.

Call today 800-475-1047 solutions@jcscomputer.com

What are the new features found in MISys Manufacturing?

- Keyboard Bindings are now persisted

- Added option to Ignore Inactive Items, Closed Orders & Posted Batches to the Data Integrity Check

- Dashboard Alerts/Advanced Find now has Does Not Contain/Does Not Exist Clauses

- Replace/Add/Remove BOM Component function enhanced to allow the resulting Revision to be marked as current

- Dashboard Alerts enhanced to consider data from related tables

- Added option to Ignore Inactive Items from the Physical Inventory Worksheet

- Purchase Orders now support auto-populating Custom Fields from Item Custom Fields.

- Added ability to close multiple Orders (POs, WOs & MOs) …

- Option to Hide Closed Orders (POs, WOs & MOs) …

- Production/Supply Schedule settings are now persisted.

Sage CRM – Powers Your Sales Pipeline

Understand the similarities and differences to other CRM applications

A Fact Finding Mission By centralizing marketing and sales communications, Sage CRM solutions bring data efficiency to your company that can help you work more effectively and measure success (or identify missed opportunities).

Sage CRM also provides a platform that can automate sales, marketing, and customer support tasks across the enterprise – resulting in a truly powerful, real-time sales pipeline and performance analytics. Here are 4 ways Sage CRM can power your sales pipeline.

Better Business Intelligence

Total Marketing Management

Better Lead Tracking

Accelerated Sales

What are the new features found in Sage CRM?

- Calendar – view a complete list of your tasks and appointments

- Use the ActiveX Document Drop to attach documents to custom entity records.

- Quick Find immediately available in search results.

- Chart points that have been made larger

- Enhance system security

- And more

Use a Free Demo to Analyze How Sage Timeslips Software

Power your firm with Sage Timeslips Software – See how Sage Timeslips can benefit you: Get set up quickly and easily with helpful wizards, templates, and training videos to guide you through the simple steps of billing your time and expenses. Sign up for a one-to-one demo. This personalized tour of Sage Timeslips can be customized to your business needs so you can see how Sage Timeslips can work for you. Sage Timeslips can also interface with QuickBooks or Sage 50.

What are the new features found in Sage Timeslips?

- Duplicate Slips to Multiple Clients (Premium only)

- Enter Payments from Accounts Receivable List

- Reverse Payments from an Existing Transaction

- Apply a Credit Transaction to Multiple Open Invoices

- Client to Client Transfers (Premium only)

Accounting Business Solutions by JCS also provides integration between Sage Timeslips and Sage 50 and QuickBooks Support and Training.

Free Demo – Review Sage 100 Field Service Management

Do you need a more powerful field service management software solution?

Sign up for a one-to-one demo. This personalized tour of Sage 100 Field Service management for Sage 100 accounting software can be customized to your business needs so you can see how Sage 100 can work for you. Field Service is a module for Sage 100 with seamless integration and is specifically designed for companies that need to automate their field service processes and information. This solution is customizable and scalable. Sage is the largest supplier of Small Business Accounting Software today. JCS also provides Field Service and Sage 100 Support and Training.

What are the new features found in Sage 100 Field Service Management?

Sage 100 field service includes a mobile field service management application designed to bring simplicity to field service with the power of Sage 100 ERP.

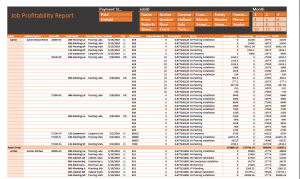

- Increase field service efficiency and revenue

- Real-time data and reporting

- Email customer invoices with link to pay electronically using Paya

- Eliminate invoice errors

- Built in Scheduling and dispatching

- Capture real-time costs for profitability on a job-by-job basis

- Track costs against contracts

- Give us a call to schedule your free demo 800-475-1047

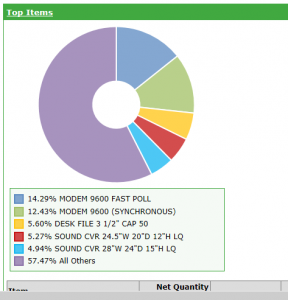

Is the new QuickBooks Point of Sale linked to QuickBooks Online Accounting Software right for your business?

Sign up for a one-to-one demo. This personalized tour of Quick Books Point of Sale by Intuit can be customized to your business needs so you can see how QuickBooks can work for you. QuickBooks is rated the number one Small Business Accounting Software for businesses today. JCS also provides QuickBooks Support and Training. Call today 800-475-1047

What are the new features found in QuickBooks Point of Sale?

QuickBooks Point of sale is easy to use and manger your retail shop. No need to enter Duplicate Transactions between multiple systems. QuickBooks POS is easy to Integrate. Easily Manage Inventory and is the No. 1 Accounting Solution. Accept Credit Cards and works Seamles sly With QuickBooks.

sly With QuickBooks.

-

-

-

- Easier access to customer information

- Compatible Physical Inventory Scanner

- Point of Sale on Microsoft Surface® Pro

How ACT CRM Software – Accounting Software Systems

By centralizing marketing and sales communications, ACT Software CRM solutions bring data efficiency to your company that can help you work more effectively and measure success (or identify missed opportunities).

ACT CRM also provides a platform that can automate sales, marketing, and customer support tasks across the enterprise – resulting in a truly powerful, real-time sales pipeline and performance analytics. Here are 4 ways ACT CRM software can power your sales pipeline.

Better Business Intelligence

- Total Marketing Management

- Better Lead Tracking

- Accelerated Sales

What are the new features found in ACT CRM Software?

Act! CRM Software includes dynamic sales pipeline management and powerful new lead generation management and Marketing Automation. There have been many improvements in reporting, custom tables, product security, Web-Windows parity, update notifications, and compatibility updates.

- NEW Plans & Pricing

- Personalized Home Screen

- Modernized Look & Feel

- Marketing Automation Features & Insights

- Targeted Data for Sales & Marketing Efforts

- Mobile App Improvements

- Greater Flexibility with Custom Charts

Review and Compare Accounting Software Systems – Sage 50, Sage 100 and QuickBooks

Discover The Right Accounting Software Systems For Your Business!

To learn more Give us a call today 800-475-1047 solutions@jcscomputer.com.

Lesson for Accounting Terms used in Accounting Software Systems

A

Accounts Payable: The amount owed to others called vendors for services or merchandise received by the organization.

Accounts Receivable: The amount owed to the organization for services or merchandise provided to others referred to as clients.

Accrual-Basis Accounting: A system of financial record keeping in which transactions are recorded as expenses when they are incurred (i.e. when a bill is received for merchandise or services provided to the organization) and as income when it is earned (i.e. when services or merchandise is provided by the organization, or the organization receives a commitment of a contribution) rather than when cash is paid or received. The alternative accounting method is Cash-basis accounting.

Accrued Expense: Expenses that have accumulated, but are not yet due or payable based on payment terms with the vendors.

Accrued Interest: Loan or Bank Interest costs that have accumulated, but are not yet due or payable.

Allocation: A method of accounting that divides expenses among different classification, division, program or administrative catagories based on a formula that recognizes the use of the resources such as use of the facility or staff time.

Allowance for Doubtful Accounts: An amount reflecting the portion of the accounts receivable which the organization reasonably believes it may not collect.

Assets: What is owned by the organization. Examples are automobiles, equipment etc.

Audit: A financial report that has been tested and verified for accuracy and prepared in accordance with Generally Accepted Accounting Principles. An essential component of the audit is the Opinion Letter.

B

Balance Sheet: These balances are perpetual and may change on a daily or less frequent basis. This financial statement reflects the financial condition – Assets, Liabilities, and Net Assets – of the organization at a particular moment in time. Referred to as a Statement of Financial Position in the nonprofit sector.

Board-Designated Funds: A condition placed by an organization’s board of directors on how an amount of money is to be used. A common type of board designation is for Operating Reserves. For accounting purposes, these funds are considered unrestricted because the condition was not specified by a donor.

Bridge Loan: A short-term loan with a specific repayment source typically from 3rd party providers, private equity, venture capital groups, family and friends.

C

Capital Expenditure: Payment of money to acquire fixed assets, such as a building or equipment

Capitalizing an Asset: Recording the cost of land, a building or equipment as fixed assets rather than as an expense when purchased.

Cash Equivalents: Funds which can be quickly and easily converted to cash; those bank accounts, money market funds or other investments which mature within 90 days.

Cash-Basis Accounting: A system of financial recordkeeping in which transactions are recorded as cash is received or spent.

Cash Flow: The movement of cash into and out of an organization; or the difference between cash receipts and cash disbursements during a period of time. The question is always is there more cash coming in than going out?

Cash Flow Statement: A report of incoming and outgoing cash during a specified period of time. Most often the beginning period cash balances, expected incoming cash and outgoing cash to forecast available cash at a future date in time.

Chart of Accounts: A report of all accounts used in accounting system, including assets, liabilities, income and expenses.

C+

Collateral: An asset (cash, buildings or other securities) which is pledged to a lender in return for a loan. Once the loan is paid in full the asset belongs to the original owner. In the event of default on a loan, the lender legally owns the right to obtain or sell the collateral to repay the loan.

Committed Grant: A contribution for which the organization has received a formal notification from the donor that an award will be made at a future date.

Conditional Promise to Give: A commitment by a donor to make a contribution to the organization if a specific requirement is met. The agreement becomes binding once the requirement is met.

Contribution: A donation, gift or transfer of cash or other assets.

Current Assets: Cash, investments, receivables, and other assets that can be expected to be available as cash within twelve months.

Liabilities and Current Liabilities: Those liabilities due to be paid now or within the next twelve months.

Current Portion of Long-Term Debt: The amount of the principal payments due and payable on loans within the next twelve months, if the original term of the loan was longer than one year.

D

Deferred Revenue: Income for which payment has been received before it has been earned. It is reflected as a liability on the Balance Sheet until it is earned and can be recognized as income in a future accounting period.

Deficit: Expenses in excess of income; an operating loss or a negative change in Net Assets.

Depreciation: The recognition, by recording an expense, of the decrease in value of a fixed asset over its expected physical or economic life. The value of Land is not depreciated.

Direct Costs: Those expenses which are specifically attributable to a program area or cost center typically, these are cost of goods sold.

E

Earned Revenue: Income received for providing services or goods, rather than as a voluntary contribution.

F

Financial Accounting Standards Board (FASB): The national governing board which sets the accounting standards known as Generally Accepted Accounting Principles (GAAP).

Fixed Assets: An asset that has a relatively long useful life, usually several years or more.

Functional Expenses: Categories of expense delineated by the type of expense: program services, management & general, and fundraising. Required for IRS form 990 and audited financial statements. Often reflect the use of allocations.

Fund Accounting: Typically, used by nonprofits. A system of accounting based on separating information into groups which reflect organizational divisions or donor-imposed restrictions.

G

General Ledger: A general ledger represents the record-keeping system for a company’s financial data

Generally Accepted Accounting Principles (GAAP): The set of norms and standards of nonprofit accounting practices established by the Financial Accounting Standards Board (FASB) to help ensure the accuracy and consistency of financial records and reports.

Grants: Contributed assets given by an individual or another organization with no reciprocal receipt of services of goods. Sometimes are given with a legal restriction imposed upon its use.

I

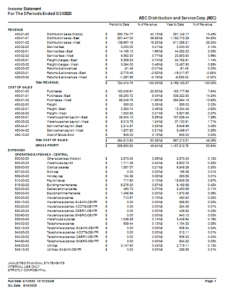

Income Statement: An income statement or profit and loss account is one of the financial statements of a company and shows the company’s revenues and expenses during a particular period.

In-kind Contribution: refers to goods, services, and transactions not involving money or not measured in monetary terms.

Internal Controls: The system of practices, procedures and policies intended to safeguard the assets of the organization from fraud or error and ensure accurate recordkeeping.

Liabilities: What the organization owes to others, including accounts payable, debts, mortgages and other obligations to pay.

Long-Term Debt/Liabilities: An obligation to pay a loan or other obligation with a maturity or due date of more than one year.

N

Net Assets: The difference between the organization’s total assets and its total liabilities on the balance sheet indicating the net financial worth for the organization. Net assets is the accumulation of the difference between cumulative income less cumulative expenses over the life of the organization. Divided into Unrestricted, Temporarily Restricted, and Permanently Restricted net assets.

Net Fixed Assets: The value of land, buildings, equipment and other fixed assets owned by the organization after the deduction of the accumulated depreciation of those assets.

Notes Payable: In accounting, Notes Payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. The balance in Notes Payable represents the amounts that remain to be paid.

Notes Receivable: The amount an organization is owed for loans made to others.

O

Operating Expense: General term for expenses incurred for all the activities of the organization.

Operating Reserve: An unrestricted fund balance set aside by the organization’s board to stabilize an organization’s finances by providing cash as a cushion for planned or unplanned future expense or losses.

Overhead: Overhead refers to the ongoing business expenses not directly attributed to creating a product or service. Typically, this is a calculated amount or percentage.

Permanently Restricted Funds: Funds which the donor has indicated may not be spent by the organization, but which are invested to produce a stream of income that can be spent. Frequently called an endowment

P

Pledge: A formal commitment to make a contribution of a specific amount.

Prepaid Expense: Prepaid expenses are future expenses that have been paid in advance

R

Refinance: To replace one loan with another, usually in order to extend the maturity, change the payment amount, or to consolidate several loans.

Release from Restrictions: The accounting transaction used to transfer temporarily restricted funds into an organization’s unrestricted accounts when the restriction has been satisfied (such as when a special project is initiated).

Reserves: An amount set aside by the Board to be used in case of losses or an unexpected expense.

Restricted Funds: Contributions which are designated by the donor for a specific use. See also temporarily restricted funds and permanently restricted funds.

Revenue: In accounting, revenue is the income that a business has from its normal business activities, usually from the sale of goods and services to customers.

S

Secured Loan: A loan for which something of value is pledged in the case that repayment cannot be made.

Short-Term Debt/Liability: A loan which is issued with a final payment date of one year or less.

Social Entrepreneurs: People who act as the change agents for society, seizing opportunities others miss and improving systems, inventing new approaches, and creating solutions to change society for the better. While a business entrepreneur might create entirely new industries, a social entrepreneur comes up with new solutions to social problems and then implements them on a large scale.

Social Enterprise: An organization or venture (within an organization) that advances a social mission through entrepreneurial, earned income strategies.

Socially Responsible Business: A venture (generally for-profit) that seeks to leverage business for a more just and sustainable world.

Support: Income from voluntary contributions and grants (as distinct from revenue, or earned income).

T

Technical Assistance (TA): Help and advice provided on a specialized subject matter.

Temporarily Restricted Funds: Contributions given by the donor or granting organization for a specific use or for use during a specific period of time. The limitation is satisfied at a defined time or when certain activities have been performed and the funds are released from restriction.

U

Unconditional Promise to Give: A pledge to make a contribution of cash or another asset without requiring the organization to meet any condition prior to receiving the contribution.

Unrealized Gain (loss): Unrealized gains and losses occur any time a capital asset you own changes value from your basis.

Unrestricted Funds: Contributions given without the donor placing any restrictions or limitations as to their use.

Unsecured Loan: A loan made without collateral.

W

Working Capital: Working capital is a financial metric which represents operating liquidity available to a business.

accounting software system, accounting software systems, accounting software, small business accounting software, review accounting software, compare accounting software

(End) Accounting Software Systems

Compare Accounting Software Systems

Compare Accounting Software Systems

sly With QuickBooks.

sly With QuickBooks.

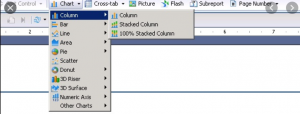

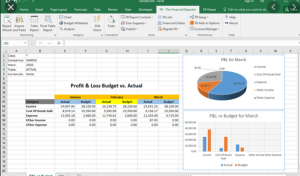

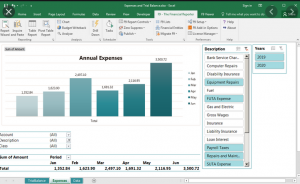

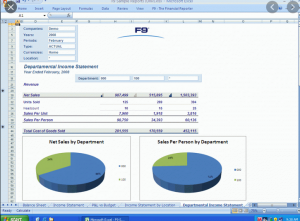

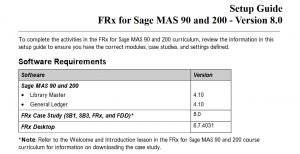

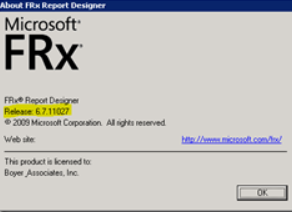

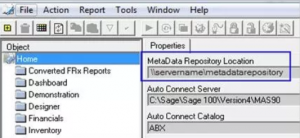

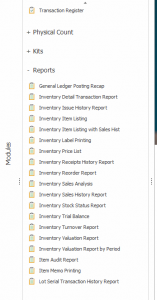

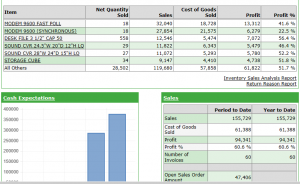

With Some releases Sage 100 Intelligence Reporting modules are included with the purchase. Check to confirm your purchase did include Sage 100 Intelligence Reporting. There are the module options.

With Some releases Sage 100 Intelligence Reporting modules are included with the purchase. Check to confirm your purchase did include Sage 100 Intelligence Reporting. There are the module options.